Emerging Markets Financing Solutions

Experience the Tandem Difference

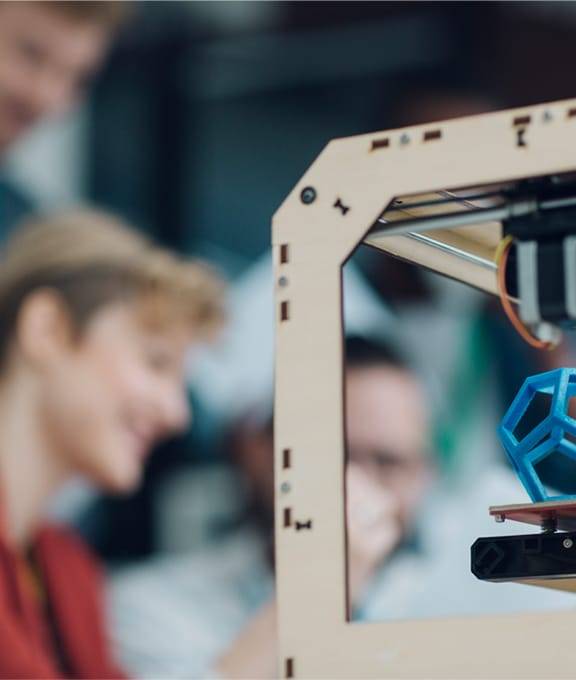

Tandem Finance is big on innovation and technological advancement, and we are excited to offer financing up to $350,000 to emerging markets looking to acquire the equipment they need immediately. Whether you’re looking to offer financing to your customers to automate their company, acquire the latest 3D printer, or upgrade their AI system, you can be sure that we have a financing plan that works for you. Our wealth of experience in the field of equipment financing has helped us craft equipment financing solutions for emerging markets that minimize costs and maximize returns. Our finance solutions have your customer’s business growth as their focus and are designed to keep you updated on the latest innovations without disrupting your monthly cash flow.

-

•Up to $350,000 financing for equipment

-

•24 - 60 months financing options -

•Funding in as little as 4 hours -

•Convenient electronic closing documents -

•Flexible lease terms and payment options -

•Professional and consistent customer service -

•Maximize Section 179 Tax deduction -

•Same day funding -

•Soft credit check, diminishing the impact on your FICO score -

•Wide credit appetite to consider all business profiles, including start-ups

Tandem Finance is the only direct lender that funds and administers small and medium loans across the credit spectrum without selling its loans to another lender. Instead, we retain and service our contracts ourselves and are committed to delivering a consistent customer service experience to our vendors.

Become a Solution for your Customers

Partner with us today

Our team offers emerging market-specific expertise combined with financing products and solutions to ensure that your customers’ financial needs are met, regardless of the market. We are all for innovation and technological advancements that make your customer’s business more efficient and boost customer satisfaction. Though these technologies are relatively new, they’re quickly evolving and are already being used in major industries like the medical, dental, aerospace, manufacturing, and construction sectors. Apply today and get started on offering financing on these innovative technological advancements!

become an approved vendorOur broad credit appetite allows most businesses to qualify for equipment finance and working capital without perfect credit or additional collateral. We provide financing directly to your business regardless of its stage of development — from start-up to established.

Advantages of Financing

- Preserve capital: Retain cash and credit lines for operating expenses

- Flexible payment options: Defer payments to accelerate return on investment

- Improve operational efficiency without a large outlay of money

- Save money at tax time with special tax deductions†

†Tandem Finance does not provide legal or tax advice. Please contact an authorized tax advisor or visit irs.gov to confirm if you qualify for this tax benefit.

Broad Range of Equipment Financing Plans

Tandem Finance has designed our emerging markets finance solutions to deliver where it matters most. We offer a broad range of financing plans tailored to meet your customer’s business-specific needs while minimizing cost and maximizing returns. 0% low rate financing, zero down, structured payments, and custom solutions with terms from 24 - 60 months are available to applicants who qualify. With our fast, flexible, and easy plans, you can offer upgrades, help expand businesses and stay ahead of the competition without straining your cash flow.